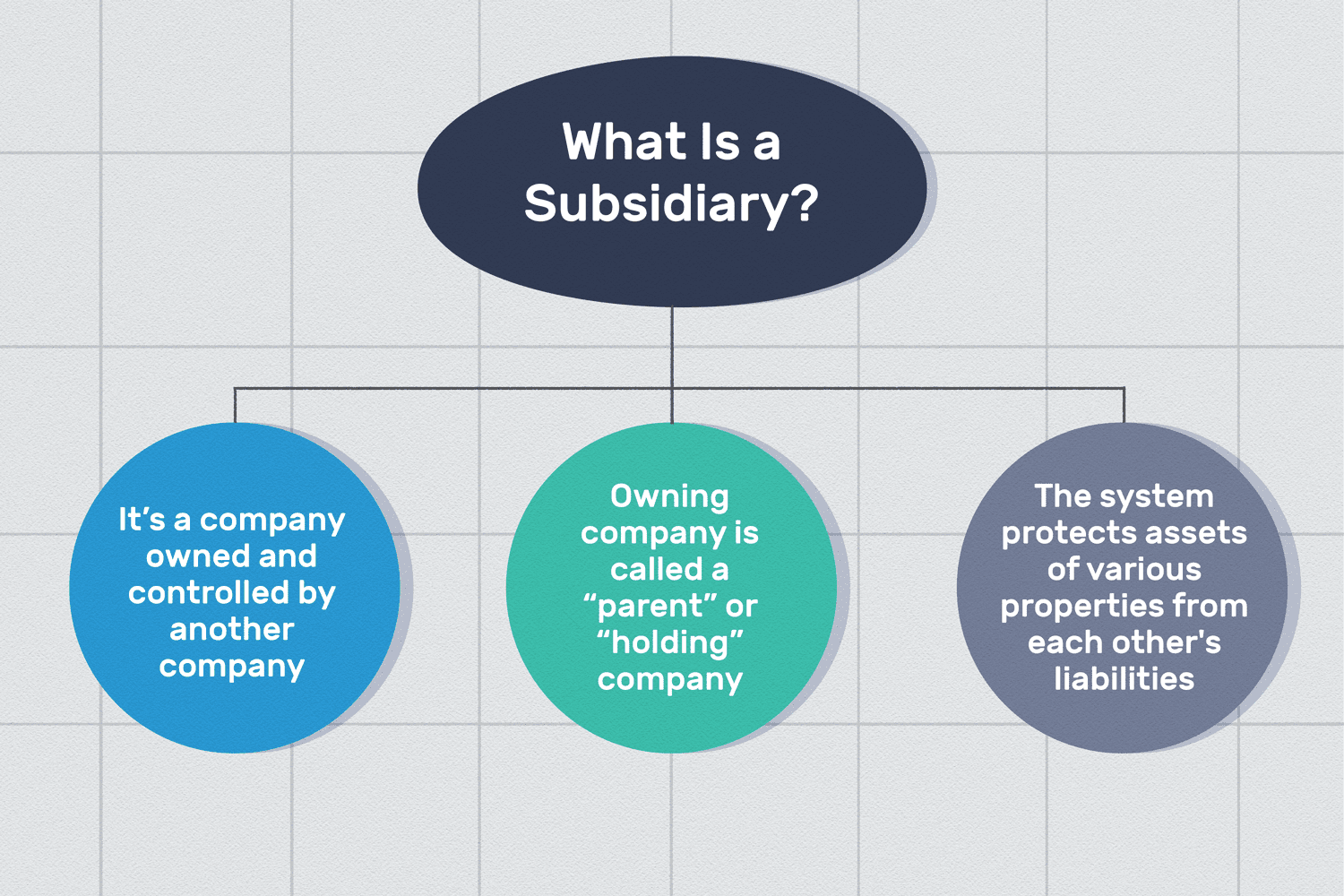

Foreign company wishing to establish a business in Kenya may do so by the registration of a branch of the foreign company or a subsidiary. In considering whether to register a subsidiary vis a vis a branch, one of the key factors to consider is the tax regime.

It is prudent to note that under the Kenya tax regime, a branch is taxed as a non-resident/ foreign company which has a permanent establishment in Kenya while a Subsidiary is taxed like a local company incorporated in Kenya.

Income tax is chargeable under corporation tax and withholding tax which has different rates for foreign vs local companies. Further, a branch can make payments to the main office without being charged Withholding tax on these payments since payments are seen to be within the same legal entity. On the other hand, a Subsidiary making payments to its Holding Company is subject to withholding tax since payments are treated as though they are made by one legal entity to a different legal entity.

However, despite branches not being charged withholding tax, there are restrictions on the deductibility of expenses such as royalties, interest, and management fees paid to the Head office which are referred to as tax deductibles. These tax deductibles in both branches and subsidiaries like local companies are NOT deducted from the taxable income of the businesses until they are computed together with all other income and used to determine the final taxable income.

Excise duty is another tax considered an indirect tax charged on the importation, local manufacture of certain products, and supply of excisable services. The tax is levied on the producer or supplier who usually passes the said tax onto the consumer by including it in the product price. An entity will ONLY pay excise duty if it deals in excisable goods or services in Kenya.

The table below is a comparative analysis of the applicable taxes between a branch and a subsidiary.

Comparison on tax due to a branch vs subsidiary company in Kenya – CLO ADVOCATES